Did he cave or brave?

Trump has put his punitive tariffs on hold, China excepted. So what now?

Never try to call The Donald. You never know what is coming next. Yesterday’s column is now somewhat overtaken by events. Trump has put all but one of his trade war tariffs on hold for 90 days.

The POTUS is still in a swinging dick contest with China, of course, which I suspect will also be resolved fairly soon when the manhood measurement is completed. Though the longer-term consequences of Trump’s upending of the card table of world trade remain, as the BBC is wont to say, to be seen.

The corporation’s economics editor, Faisal Islam, says confidently that Trump panicked because of the sudden selling of US Treasury bonds. Bond dealers were effectively saying that T-bills were no longer a safe haven. This was making the yield curve rise to crisis levels. Interest payments would therefore increase on the $36 trillion US debt pile. So Trump blinked. This is very much how the BBC also interpreted the former Tory Prime Minister Liz Truss’s disastrous mini-budget in 2022. She resigned as PM; but Donald Trump will not.

He insists, on the contrary, that the 90-day stay of execution is because the 50-odd countries targeted—China excluded—have lined up to “kiss my arse”, as he put it, with his customary disregard for the conventions of diplomatic language. That’s a lot of backside smooching. He has a big arse, fortunately. Countries like Vietnam are, he says, desperate to deal, so there is no longer a justification for punitive tariffs. “It was all part of the plan,” said Treasury Secretary Scott Bessent. Not many City pundits agree, but then you wouldn’t expect them to.

Who really knows what happened in the mind of Trump? But one puzzle remains. If the US President is serious about doing zero-tariff deals with all those countries—which is the stated aim—how is he going to raise that $2 billion a day he was promising to help cut the deficit? I know there is not much point asking this question. By tomorrow, everything will probably have changed once again. Trump may by then be demanding reparations for lost trade.

But he doesn’t seem to be losing too much support from the MAGA base. There have been wobbles, but nothing serious. They seem to expect turmoil and don’t care for the pious lectures from financiers and media pundits. They are pleased to know that the elites are hurting.

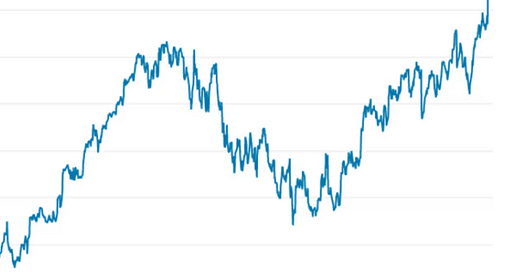

And a final thought. With the stock market losing and then regaining nearly ten per cent of the entire market within 48 hours, anyone who bought the dip has made a fortune. Is there a George Soros lurking in the corners of the Bitcoinverse? He bet against the EU Exchange Rate Mechanism in 1990 and made billions.

Trump’s shock-and-roll was a gift to insider share dealers. But really, anyone savvy enough to realise that Trump was likely to change tack—and with enough cash—could have made a speculative killing. It wasn’t a difficult bet. The likelihood was always that Trump would U-turn, as he did last month with Canada and Mexico. It’s the old story: the market panics, someone, somewhere will be making a buck.

Trump’s acolytes of course were quick to claim the win but it was pretty clearly the bond markets wot did it. Bond yields spiked by 0.6% in 48 hours which is massive and potentially the proverbial canary in the coalmine for the wider financial plumbing. And Trump effectively admitted the point when he said “people were getting yippy”.

The MAGA crowd are behind him at the moment because these matters take time to work through to “Main Street” but if this erratic decision making continues it’s only a matter of time before there’s a significant impact.